Renters Insurance in and around Grapevine

Looking for renters insurance in Grapevine?

Renting a home? Insure what you own.

Would you like to create a personalized renters quote?

- Grapevine

- Colleyville

- Southlake

- Hurst

- North Richland Hills

- Bedford

- Euless

- DFW

- Tarrant County

- Fort Worth

- Dallas

- Keller

- Mid Cities

- Dallas Fort Worth

- North Texas

- Dallas County

- Irving

- Watauga

- Coppell

- Arlington

Calling All Grapevine Renters!

No matter what you're considering as you rent a home - size, number of bedrooms, number of bathrooms, condo or apartment - getting the right insurance can be essential in the event of the unexpected.

Looking for renters insurance in Grapevine?

Renting a home? Insure what you own.

Protect Your Home Sweet Rental Home

No one knows what tomorrow will bring. That’s why it makes good sense to plan for the unexpected with a State Farm renters policy. Renters insurance protects the things inside your space with coverage. If your rental is affected by a theft or a tornado, some of your most treasured items could have damage. Without adequate coverage, you may struggle to replace the things you lost. It's scary to think that in one moment, everything you own could be lost or destroyed. Despite all that could go wrong, State Farm Agent Ed Lair is ready to help.Ed Lair can help offer options for the level of coverage you have in mind. You can even include protection for valuables beyond the walls of your home. For example, if your car is stolen with your computer inside it, a pipe suddenly bursts in the unit above you and damages your furniture or your bicycle is stolen from work, Agent Ed Lair can be there to help you submit your claim and help your life go right again.

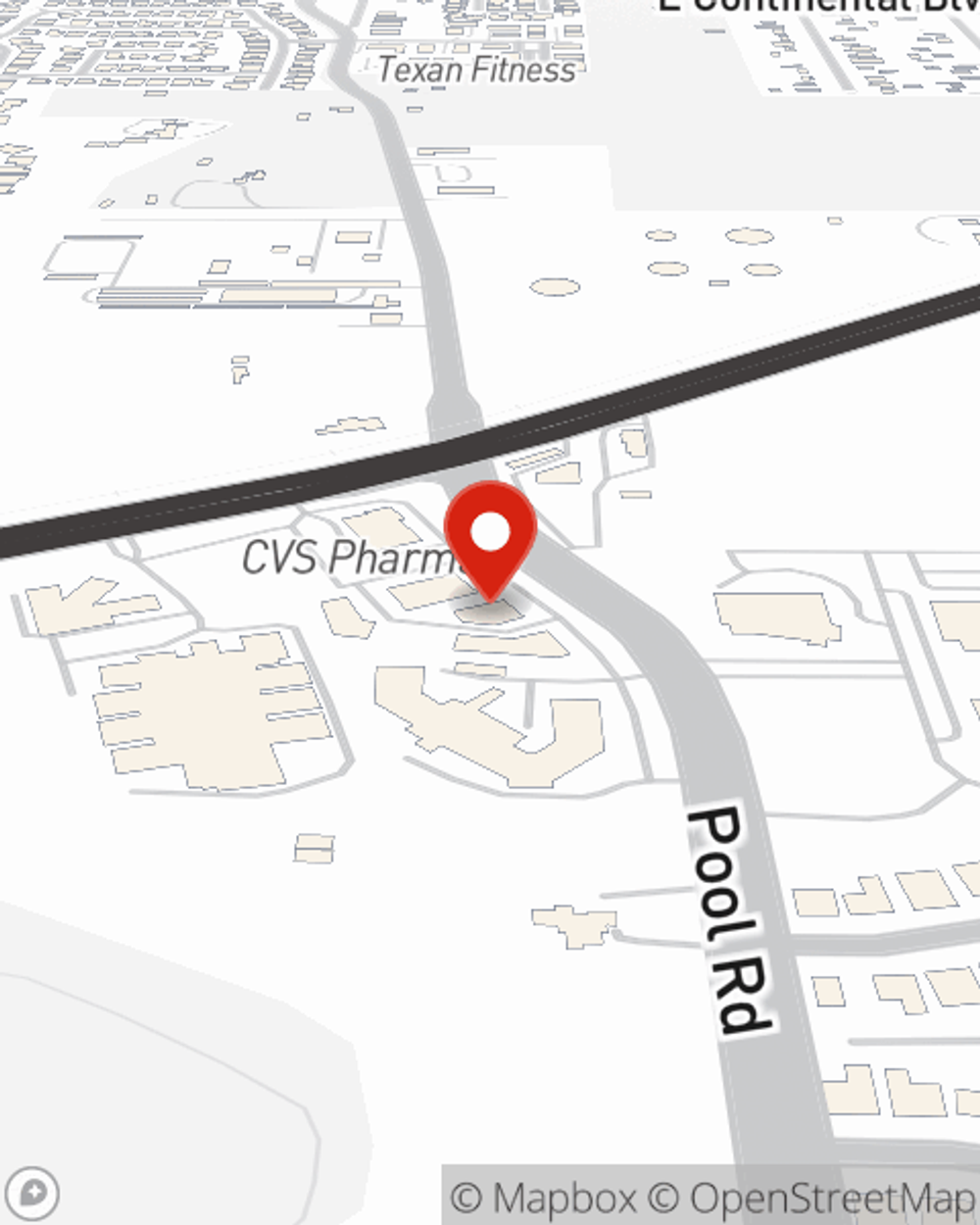

Get in touch with State Farm Agent Ed Lair today to experience how the leading provider of renters insurance can protect your possessions here in Grapevine, TX.

Have More Questions About Renters Insurance?

Call Ed at (817) 552-5247 or visit our FAQ page.

Simple Insights®

Do you need earthquake insurance if you don't live on the coast?

Do you need earthquake insurance if you don't live on the coast?

According to USGS, various U.S. locations have experienced earthquakes of magnitude four or more in recent years. Earthquake insurance can be valuable to all homeowners.

What to do after a house fire

What to do after a house fire

Consider these tips to help you and your family recover after a house fire.

Simple Insights®

Do you need earthquake insurance if you don't live on the coast?

Do you need earthquake insurance if you don't live on the coast?

According to USGS, various U.S. locations have experienced earthquakes of magnitude four or more in recent years. Earthquake insurance can be valuable to all homeowners.

What to do after a house fire

What to do after a house fire

Consider these tips to help you and your family recover after a house fire.